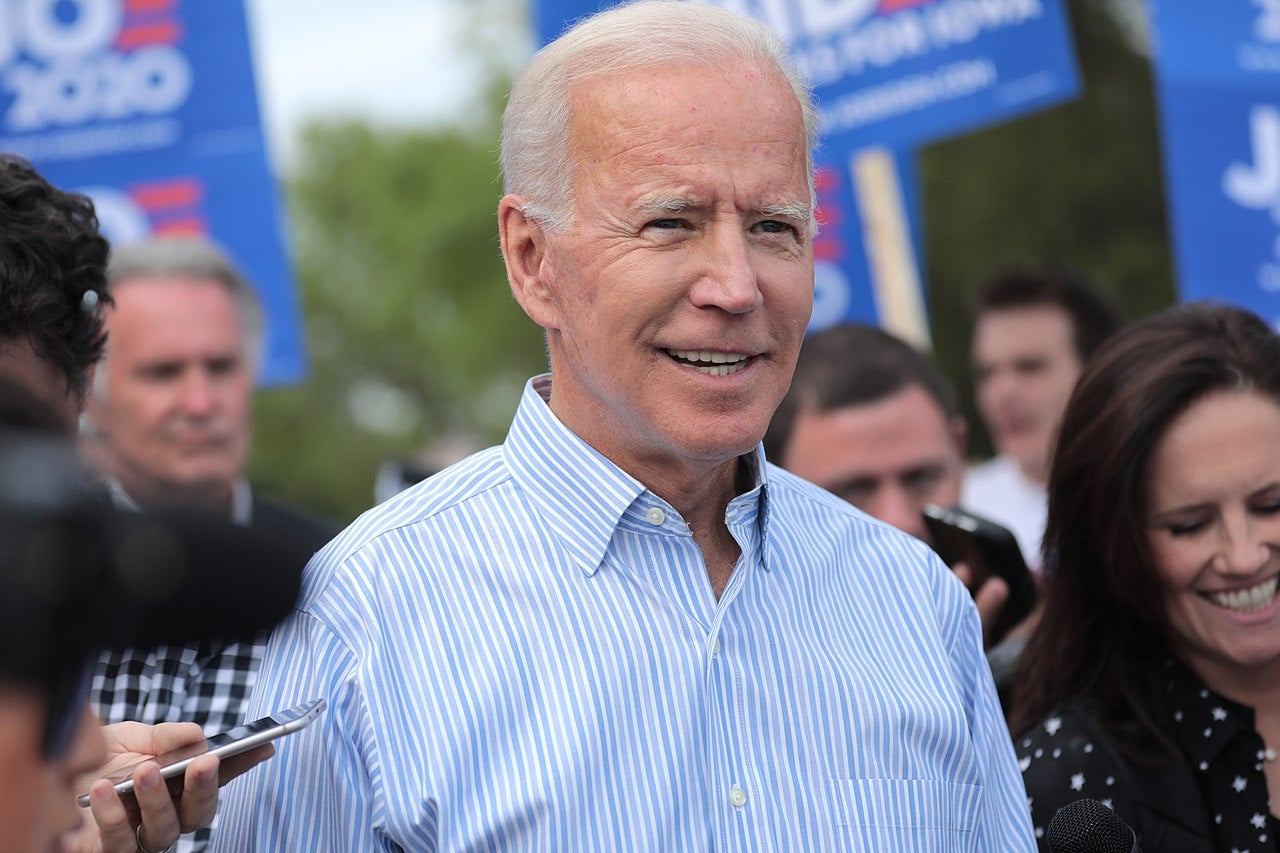

After days of manic counting, speculation and a great deal of drama, Democrat nominee Joe Biden and his vice president Kamala Harris have sealed their win against Donald Trump in the US election.

The pair’s victory came amid criticism from the Trump administration, which is blaming the result on electoral fraud and calling for a recount of ballots in several swing states including Georgia and Pennsylvania.

Despite these remarks, Biden has now kicked off his presidential transition period with a view to moving to the White House in January.

Maritime stakeholders across the US and beyond have been closely following the election’s developments to find out what future would await them. As Ship Technology previously reported, incumbent President Trump has played a significant role for the industry, supporting some of its core segments while leaving others without financial aid in the midst of the Covid-19 pandemic.

But now that the era of the controversial Republican is over, what should the sector expect from Biden?

Ending the China trade war

President Trump’s four years of attrition warfare with China and his consequent strategies for international trade are expected to change once Biden takes office, according to online valuation, AIS and market intelligence service VesselsValue.

Based on previous analysis, VesselsValue chief strategy officer Adrian Economakis believes this will be particularly evident in the bulker and container sectors. “We expect Biden will be relatively better for the [these] sectors than Trump would have been because Biden is expected to be more pro international Trade and less for protectionism than Trump,” he comments.

“The people of this nation have spoken, they’ve delivered us a clear victory, a convincing victory, a victory for we the people.”

President-elect Joe Biden is making a victory speech after winning the US election.

Live #Election2020: https://t.co/Mve6K4CZhA pic.twitter.com/3K1jaN90Xb

— SkyNews (@SkyNews) November 8, 2020

Over the past four years, the Republican’s trade war with China has taken a heavy toll on bulkers. “Trump was unpredictable and the safe money if he was re-elected was that there would likely have been further protectionist policies put into place,” he adds. “The same is true for the container sector.”

Yet this is not expected to continue with the Biden administration, which will likely favour an easing of some tariffs and support containerised trade. “Global seaborne shipping embraces free trade and globalisation,” comments BIMCO chief shipping analyst Peter Sand. “This will be a huge benefit to the industry if the trade barriers are torn down rather than put up.”

However, Economakis warns that Biden has also campaigned for policies to support US jobs, so could still impose additional trade tariffs to this end. “Biden’s victory could be bad news for the tanker sector,” he adds. “This is because tankers tend to boom in time of volatility and uncertainty [and] Biden’s presidency is expected to remove some of the volatility and also possibly remove some sanctions.”

As for the oil sector, Sand says that Biden’s work will be crucial in driving demand recovery. “If the next President successfully can contain the virus, then at least demand can recover faster and that is vital for the mid-term of shipping demand,” he adds.

Winds of change for the offshore sector

Stakeholders across the US offshore sector have been welcoming Biden’s election in what they hope to be a new era of opportunities with the Democrat administration.

“From offshore wind projects along the Atlantic Coast to oil and gas production in the Gulf of Mexico, the benefits of American energy production lift every American, regardless of party,” the National Ocean Industries Association (NOIA) president Erik Milito said in a statement last week. “NOIA congratulates President-elect Biden on his election win and looks forward to working with his administration and the incoming Congress.”

NOIA congratulates President-elect @JoeBiden and Vice President-elect @KamalaHarris on their election. Together, we can pursue an offshore energy agenda that helps every American.

NOIA Statement: https://t.co/Sajk7pUlwM pic.twitter.com/lI39zqPgIL

— National Ocean Industries Association (@oceanindustries) November 8, 2020

Over the course of his campaign, Biden has been vocal on the need to shift to a more sustainable economy, setting out plans to reduce carbon emissions across all sectors, including shipping. “President-elect Biden has laid out his plan to combat climate change through a $2trn clean energy and infrastructure plan [which] would likely have a significant impact on the US offshore maritime market,” comments Cozen O’Connor Attorney Jeff Vogel. “If Biden’s plan is implemented, US-flag and non-US-flag operators should anticipate a reduction in offshore oil and gas exploration and development opportunities.”

On the other hand, he points to Biden’s pledges to install “tens of thousands of wind turbines”, a plan that would help “offset or even exceed the opportunities that would be lost in the offshore oil and gas industry”.

Unlocking a more sustainable maritime sector

Beyond offshore opportunities, many are hoping Biden and Harris will keep their pledge to drive sustainability through several other initiatives.

Having often voiced their intentions to re-join the Paris Agreement on climate change after Trump’s withdrawal, the pair is likely to pursue decarbonisation strategies for the domestic shipping industry. “We may see more preference to LNG fuelled vessels or ways to limit vessel emissions,” explains Economakis, while Vogel adds: “Operators that have made significant long-term capital investments into LNG-fueled vessels, and the related port infrastructure, will be relieved that their investments once again have White House support.”

President-elect #Biden has promised the most comprehensive #climate plan of any President to date, and we need to hold his administration to that promise.

Learn the threats to our ocean we’re encouraging the Biden administration to focus on combatting:https://t.co/RW1h1yAgEn https://t.co/RNDXTJjjWQ

— Ocean Conservancy (@OurOcean) November 9, 2020

This is welcomed news for US non-profit environmental advocacy group Ocean Conservancy, whose shipping emissions campaign manager Dan Hubbell comments: “It’s been heartening to see that the incoming administration included the goal of ‘Lead[ing] the world to lock in enforceable international agreements to reduce emissions in global shipping’ in their climate platform.

“More ambitious climate action at IMO would certainly be a start, and something the administration could do on day one.”

He believes that the Biden administration could also drive significant change in the domestic maritime sector, with initiatives including “dedicating additional funding to research, development, and deployment of zero-emission ships and fuels, or developing domestic marine ‘highways’ that support green shipping in the US”.

Increased focus on port development

Hubbell believes that ports could become another focus area of Biden’s sustainable strategies in the maritime industry. One way to do so could be the introduction of a Monitoring, Reporting, and Verification system in ports that would keep track of emissions and hold the sector accountable for its pollution levels. “The concept is already included in legislation this Congress as part of the Ocean Based Climate Solutions Act,” he says. “A Biden administration could champion its implementation.”

With the economy in freefall, the American Recovery and Reinvestment Act (ARRA) provided $787 billion for state/local support, infrastructure, energy independence – to put people back to work. The challenge was to spend that money quickly, but without fraud, waste, abuse. 2/11 pic.twitter.com/xVm9UQRR8T

— Andrew McLaughlin (@McAndrew) November 3, 2020

Beyond sustainability, Cozen O’Connor’s Vogel anticipates that port development will be a pillar of the Democrat administration’s ‘Build Back Better’ infrastructure investment plan. The President-elect was previously one of the makers of the Obama administration’s American Recovery and Reinvestment Act (ARRA), which led to substantial port investments.

“The success of ARRA has led to new programmes that will likely receive further support from the Biden administration, such as the Port Infrastructure Development Program, which has provided hundreds of millions of dollars in grant funding to improve facilities within, connecting to, out of, or around coastal seaports, inland river ports and Great Lakes ports,” he comments.

No changes to the Jones Act

According to Colin Grabow, a policy analyst at the Cato Institute’s Herbert A. Stiefel Center for Trade Policy Studies, many US shipping companies will likely breathe a sigh of relief as the Biden administration looks keen on supporting the Jones Act.

Passed in 1920, the Jones Act restricts waterborne transportation between two U.S. points to vessels that are U.S.-built, U.S.-flagged and mostly owned and crewed by Americans— which has major implications for the offshore wind industry. #EndTheJonesAct https://t.co/y4O0IqOI8e pic.twitter.com/Y5uBXra8gr

— Cato Institute (@CatoInstitute) November 5, 2020

Having celebrated its 100th anniversary earlier this year, the Jones Act is a section of the 1920 Merchant Marine Act. It’s known worldwide as one of the strictest existing cabotage laws, allowing only US-flagged and built ships to move goods between national ports. It also states that vessels must be registered in the US with 75% of crew formed by US citizens.

“Given President-elect Biden’s stated support for the Jones Act, as well as the lack of appetite for reform of the law in Congress, prospects for its near-term liberalisation [of the sector] appear remote,” comments Grabow, who spoke to Ship Technology this summer about the negative aspects of the Jones Act.

“As such, continued stagnation of the US commercial maritime sector is virtually assured. So long as policymakers refuse to alter this outdated and archaic law to better reflect modern-day realities, the domestic maritime sector will be of increasingly limited relevance to the US economy and its transportation needs.”