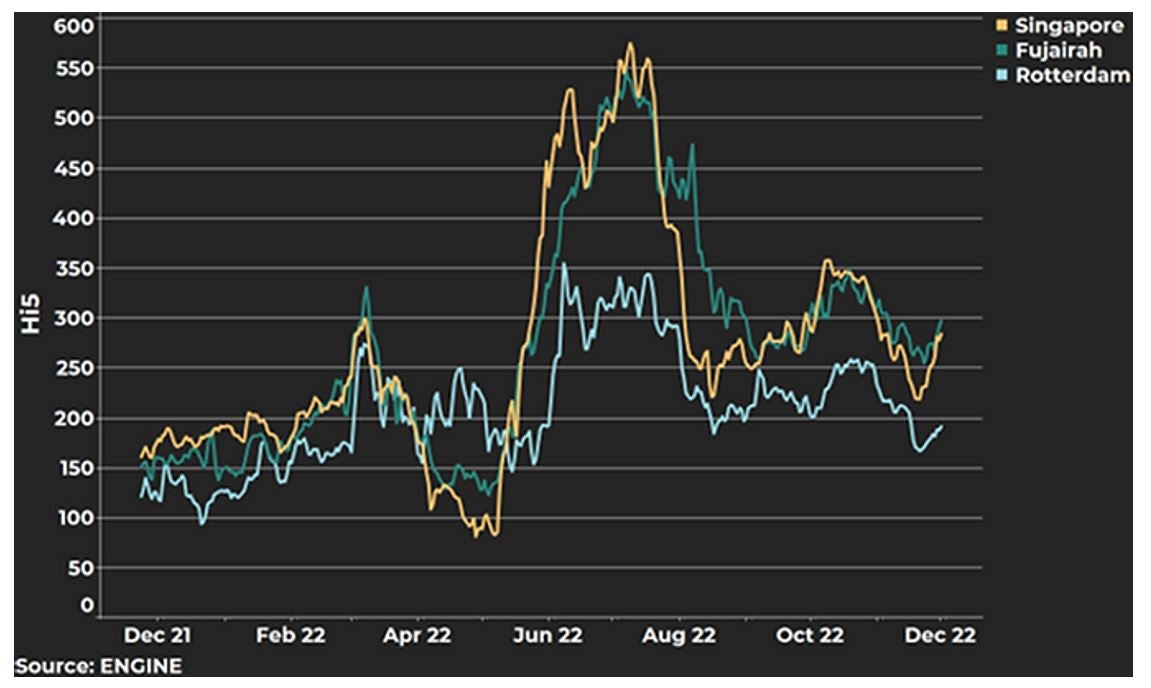

Hi5 spreads have blown wide open for sustained periods. Who would have thought that the IMO 2020 peak spreads could be surpassed? Well, last summer, Hi5 spreads in Singapore and other major bunker ports did just that and topped previously unthinkable highs.

Singapore’s Hi5 spread leapt up from less than $100/mt in early May to an all-time record of $575/mt in July. That was way beyond anyone’s expectations and more than $200/mt above the previous peak levels seen right after the IMO 2020 sulphur cap came into force.

Hi5 spreads in Singapore, Fujairah, and Rotterdam in the past year

Shipowners have recently been eager to book scrubber retrofits to take advantage of wide Hi5 spreads in the coming months and years. As we all know, the lead-up to IMO 2020 saw peak interest in scrubber investments and shipowners lining up to get vessels retrofitted or built with scrubbers in shipyards. Order books were filling up fast and scrubber manufacturers were fully booked months ahead.

Evidence from the past six months of Hi5 spreads and future projections of these staying wide could very well trigger another flurry of scrubber orders. Clean Marine is now increasing its capacity to meet that demand.

“We are now ramping up our scrubber installations fully because we believe momentum is building,” Clean Marine’s Nicholas Hvide Macleod says. “Hi5 spreads look very lucrative going forward.”

Looking ahead in the paper market, Singapore’s Hi5 spread is projected to hold above $190/mt on average next year. The port’s current delivered bunker spot spread is approximately $285/mt, and in recent months, we have seen that the Hi5 spread in the spot market has overperformed by approximately $100/mt above its paper equivalent.

If we look at current fuel cost savings for a scrubber-fitted non-eco Capesize tanker bunkering HSFO in Singapore, with the current spot discount of $285/mt to VLSFO, its fuel cost savings run up to $14,250 per day if it consumes 50mt/day of HSFO. This means that its scrubber can be paid back in nearly 17 months.

The months and years ahead of us are also poised to serve up wide spreads, with strong refining margins and lots of HSFO produced as a by-product. This should weigh on HSFO prices while distillates and other VLSFO blendstocks further up the barrel are running low in storage and could be depleted further, as sanctions on Russian oil products come into force in two months.

In fact, Singapore’s Hi5 spread has averaged $351/mt in the past six months and is forecast to remain wide, in part due to favourable HSFO supply-demand dynamics in the foreseeable future.