It is fast becoming clear that shipping companies have evolved beyond their immediate, journey-specific response to the escalation of hostilities in the Red Sea to a strategic approach that has been embedded in 2024 plans.

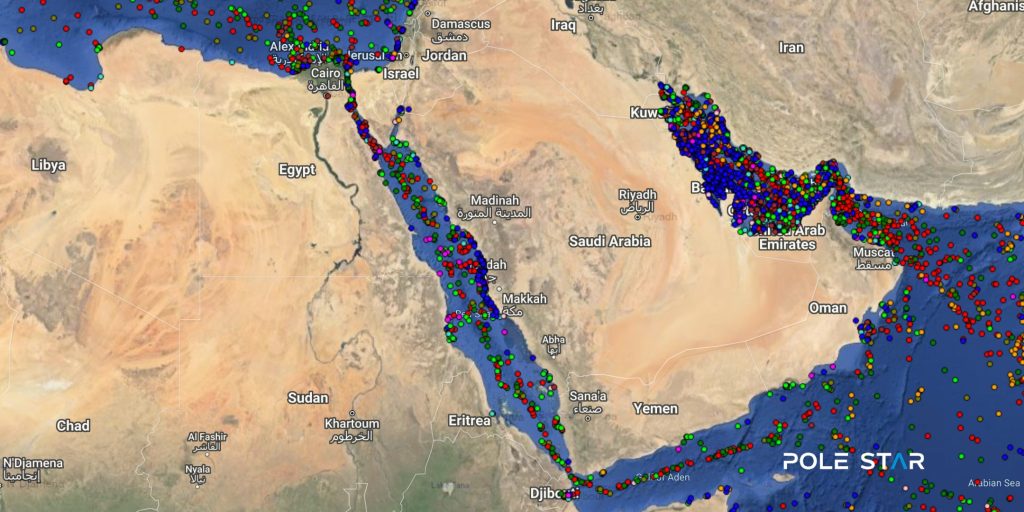

Data from Pole Star confirms a significant reduction in the number of vessels using the Red Sea. Despite the additional cost and delay associated with rerouting via the Cape of Good Hope, the number of cargo ships and tankers travelling through the Red Sea dropped almost a quarter in the last few months, from 830 in October 2023 to 626 in February 2024.

Rerouting decisions are, of course, influenced by a number of factors, including cargo, cost and risk perception; but with the cost of war insurance rising – especially for US, UK, and Israeli shipping firms – the shift towards the Cape of Good Hope is increasing.

For many firms, the experience in March 2021 when the Ever Given container ship blocked the Suez Canal, causing an unprecedented shipping backlog, has provided vital insight to support these rerouting decisions. The additional time required for the Cape of Good Hope route, as well as issues of fuel consumption and emissions, were already understood.

Firms have been able to quickly calculate the implications for crew, including the potential need to extend contracts by several weeks and delay the onboarding of new crew members.

This information is now firmly embedded in shipping companies’ emergency response plans, enabling rapid, vessel-by-vessel decision-making based on crew costs, fuel and state of repair, balanced against the potential time-sensitive nature of the cargo commodity and possible penalties for missed delivery deadlines.

What is different this time around is the risk assessment and insurance premium. To the existing baseline calculations, companies are quickly adding the cost of war insurance as well as a vessel-by-vessel perception of risk associated with the targeted nature of attacks.

Data Transparency

This current disruption to global shipping is just one more example of a global supply chain facing constant and ever-evolving challenges.

The maritime industry increasingly recognises the vital importance of fast access to an array of data sources to support complex risk assessment and rerouting decisions. The rapid digitisation occurring throughout the industry is supporting fast decision-making, but emergency response – as well as day-to-day activity – remains challenged by the lack of open data.

Shipping companies need instant visibility of an array of data from multiple sources, and without open Application Programming Interfaces (API), integrating these diverse data resources is incredibly challenging. The slow, painstaking integration process is adding significant time and cost to digitisation projects, and delaying access to the consolidated information resources and analytics that have the power to transform the speed and power of decision-making.

Furthermore, as companies increasingly look to add sensors across their vessels to provide vital information to improve efficiency and safety and support preventative maintenance, uncertainties over data ownership are arising. The shipping company may own the sensor, but the ownership of the valuable data recorded by that sensor – the temperature, fuel consumption, or engine emission reading – often turns out to have been retained by the OEM.

Fast access to high-quality data is transforming the maritime industry both day-to-day activity and emergency response. Solutions such as hardware-free voyage optimisation systems that deliver fleet monitoring, regulatory compliance, performance analytics and voyage optimisation in a single view are providing seamless access to vital information both onboard and onshore.

However, these data issues clearly need to be urgently addressed if the maritime industry’s adoption of digitisation is to continue at pace to provide shipping owners with the trusted, real-time insight required to respond to the next emerging crisis.